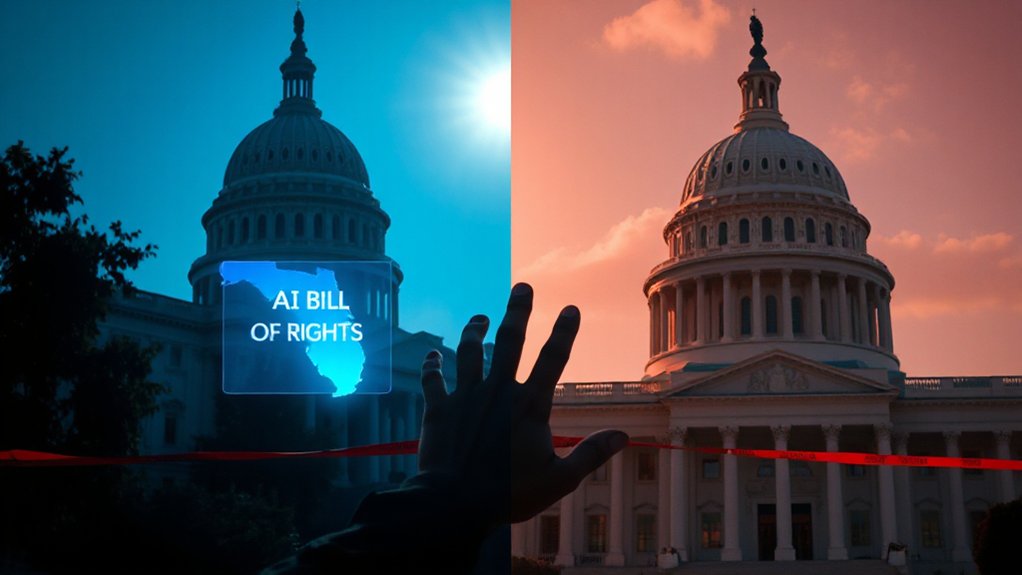

Florida lawmakers are advancing Bill SB 794 to prohibit insurance companies from denying claims based solely on AI decisions. The legislation requires qualified human professionals to review and sign off on all claim denials. Sen. Jennifer Bradley’s bill passed its first committee unanimously and needs approval from two more committees before a full Senate vote. The measure aims to increase transparency and protect consumers from potentially biased algorithms. More details reveal the growing push for AI accountability.

Florida lawmakers are taking steps to guarantee that artificial intelligence won’t be the only decision-maker when it comes to insurance claims. A new bill, SB 794, filed by Senator Jennifer Bradley of Fleming Island, aims to prevent insurance companies from using AI as the sole basis for denying claims.

The legislation requires a “qualified human professional” to review any claim denial before it’s issued to a customer. This bill has already passed the Senate Banking and Insurance Committee with unanimous support and needs approval from two more committees before heading to a full Senate vote.

Florida lawmakers demand human oversight of AI insurance decisions, with unanimous initial committee support for the protective measure.

Under the proposed law, insurers must have humans such as supervisors, claims managers, or licensed adjusters review AI decisions. These professionals must have authority over the claim and personally sign off on any denials. Insurance companies would need to clearly identify who reviewed the decision and provide a statement confirming that AI wasn’t the only factor in denying the claim.

The bill also creates new compliance requirements. Insurers would need to submit regular reports, face potential audits of claim denials, and maintain detailed documentation of each review, including the reviewer’s name, title, and when the review took place.

Florida’s push comes as AI plays an increasing role in insurance. Companies currently use AI for risk assessments on homes and neighborhoods, quick damage evaluations, and even drone inspections. While these tools improve efficiency, concerns about accuracy and bias have grown. This legislation addresses the lack of transparency in AI operations that often complicates accountability when algorithmic decisions affect consumers. Senator Bradley has also introduced SB 790 that would protect consumers from having wind policies canceled due to flood damage from hurricanes. Representative Hillary Cassel has filed a broader House bill with similar human review requirements that has yet to be discussed in committees.

Support for the bill comes from various groups, including the Florida Medical Association and Insurance Consumer Advocate Tasha Carter. They believe it strikes a balance between technological innovation and consumer protection.

Florida isn’t alone in addressing AI in insurance. California already passed a measure ensuring healthcare decisions are made by providers rather than algorithms. Meanwhile, lawsuits in California and Minnesota challenge AI use in health insurance, and the National Association of Insurance Commissioners is developing guidance on the issue.