AMD and Oracle stand out as undervalued AI stock opportunities. Both companies trade below their fair value estimates while offering significant exposure to the growing AI market. AMD’s semiconductors power machine learning systems, while Oracle has successfully integrated AI into its cloud services. Unlike volatile pure-play AI stocks, these established companies provide more stable investment potential in a sector projected to reach $1.8 trillion by 2030. The right AI investments could transform portfolio performance for years to come.

The artificial intelligence boom continues to transform the investment landscape in 2024. With the global AI market projected to reach $1.8 trillion by 2030 and growing at over at 36% annually, investors are seeking opportunities beyond the well-known tech giants.

Among the most promising yet undervalued AI stocks is Advanced Micro Devices (AMD). Currently rated 4 stars by Morningstar, AMD trades about 27% below its fair value estimate. The company has established itself as a key player in the semiconductor space that powers AI applications. AMD’s chips are essential components for everything from computer vision to machine learning systems.

Oracle (ORCL) represents another undervalued opportunity in the AI sector. With a 4-star Morningstar rating, Oracle has integrated AI into its cloud services and database products. The company has transformed from a traditional software provider to an AI-enabled cloud services giant, positioning it to benefit from expanding enterprise AI adoption. Like industry leaders Salesforce and ServiceNow, Oracle is building its competitive advantage through defensible datasets that enhance its AI capabilities.

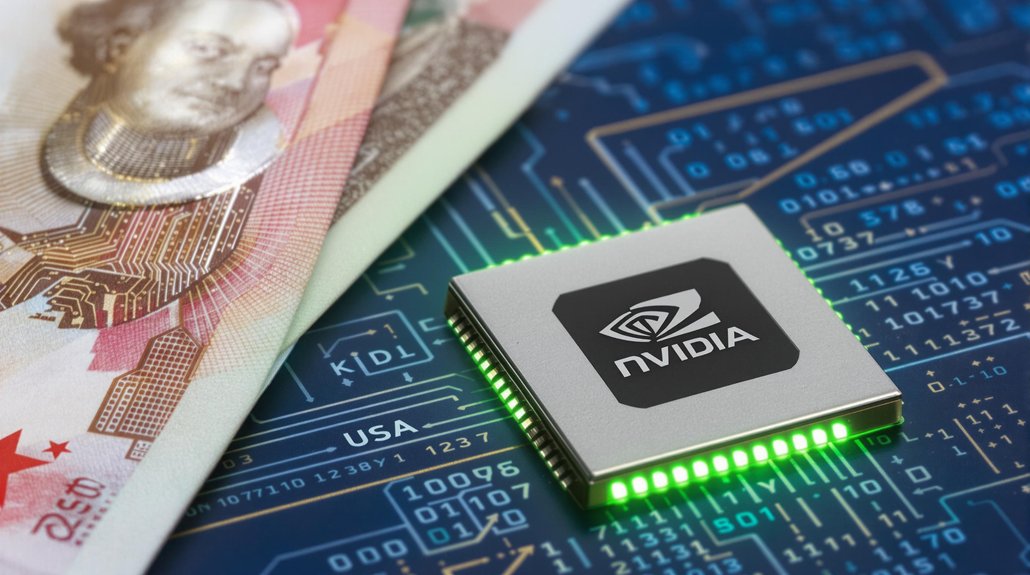

These stocks offer exposure to AI growth while maintaining more reasonable valuations compared to headline-grabbing names like NVIDIA. They’re part of a broader trend where AI is driving returns in unexpected sectors beyond the most obvious tech companies. Early investors who identified companies implementing AI solutions are seeing real profits from their strategic positions.

For investors concerned about risk, these established companies provide AI exposure with less volatility than pure-play AI firms like SoundHound AI or Upstart Holdings, which have seen one-year returns of 57% and 75% respectively, but with significant price swings. Investors should remain cautious of companies that use AI as a buzzword to inflate share prices without solid fundamentals.

The AI revolution extends beyond software into robotics, autonomous vehicles, and virtual agents. Oracle and AMD support these applications through their fundamental technologies.

Market observers note that geopolitical issues affecting semiconductor development and potential regulatory challenges remain risks for the AI sector. However, as AI becomes embedded in numerous technology applications, companies like AMD and Oracle are positioned to benefit from this long-term trend regardless of short-term market fluctuations.