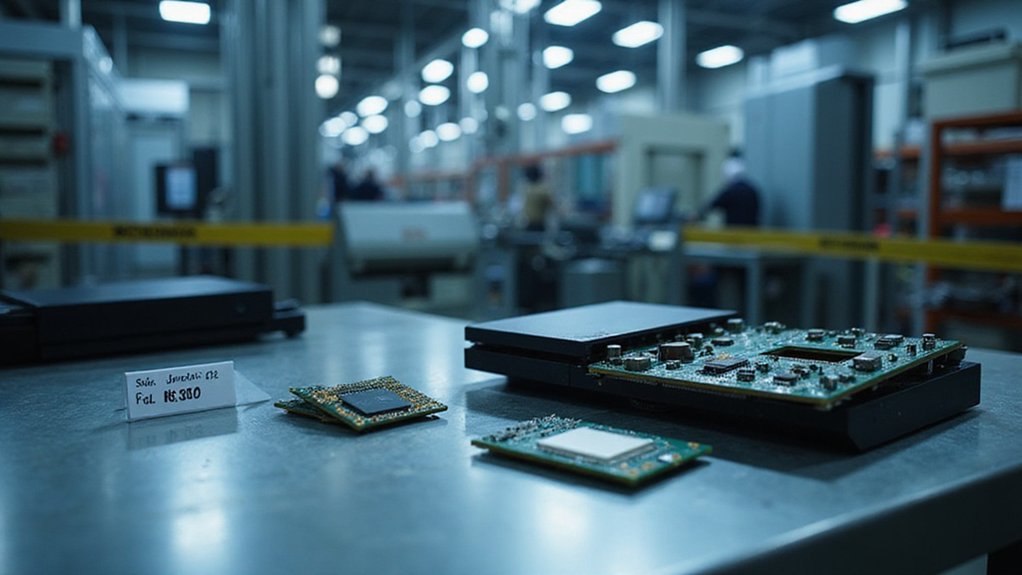

The semiconductor industry’s growth is slowing, with chip revenue expected to rise by just 11% in 2025, down from 19.1% in 2024. This deceleration is driving up gaming console production costs as manufacturers face higher component prices and limited capacity expansion. Consumers will likely see pricier next-gen consoles and potential stock shortages. The industry’s $185 billion in capital expenditures for 2025 signals significant challenges ahead for affordable gaming hardware.

While the semiconductor industry continues to grow, a notable slowdown is expected in 2025 that could impact gaming console prices. Global chip revenue is projected to reach $697 billion in 2025, representing an 11% year-over-year increase. This marks a significant deceleration from the 19.1% growth seen in 2024.

The slowdown is particularly evident in server markets, where growth is expected to drop from 42% in 2024 to just 11% in 2025. Factors contributing to this trend include stabilized memory prices and weak automotive demand. Supply chain disruptions continue to create bottlenecks for manufacturers.

These industry trends directly affect gaming console production costs. As chip innovation slows and manufacturing expenses rise, component prices increase. The projected $185 billion in capital expenditures for 2025 will expand capacity by only 7%, meaning supply may struggle to meet demand. The industry is shifting focus toward enhancing chiplets and packaging to maintain performance gains as traditional silicon scaling becomes more challenging.

For gamers, this translates to higher retail prices for new consoles. The rising cost of semiconductor components establishes a higher baseline for console production expenses. Manufacturers face difficult choices: delay new models, reduce features, or pass costs to consumers.

Supply issues could also lead to persistent stock shortages, creating opportunities for scalpers to drive prices even higher. The situation makes it harder for smaller companies to enter the console market, potentially reducing competition and consumer options.

The total stock market value of the top 10 global chip companies reached $6.5 trillion in December 2024, showing 93% growth from the previous year. However, there’s a widening performance gap between different types of chip companies. Those focused on AI chips are thriving while traditional manufacturers struggle. The record-breaking yearly total of $627.6 billion in global semiconductor sales in 2024 hasn’t translated to affordable gaming hardware.

Companies are responding with investments in advanced packaging techniques and new materials to improve performance while controlling costs. They’re also implementing AI-driven manufacturing and automation to offset rising expenses.

Despite these efforts, the semiconductor slowdown appears poised to make next-generation gaming consoles more expensive for consumers.

References

- https://www2.deloitte.com/us/en/insights/industry/technology/technology-media-telecom-outlooks/semiconductor-industry-outlook.html

- https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2025/global-semiconductor-industry-outlook-2025.pdf

- https://www.semiconductors.org/global-semiconductor-sales-increase-19-1-in-2024-double-digit-growth-projected-in-2025/

- https://evertiq.com/news/56822

- https://www.infosys.com/iki/research/semiconductor-industry-outlook2025.html