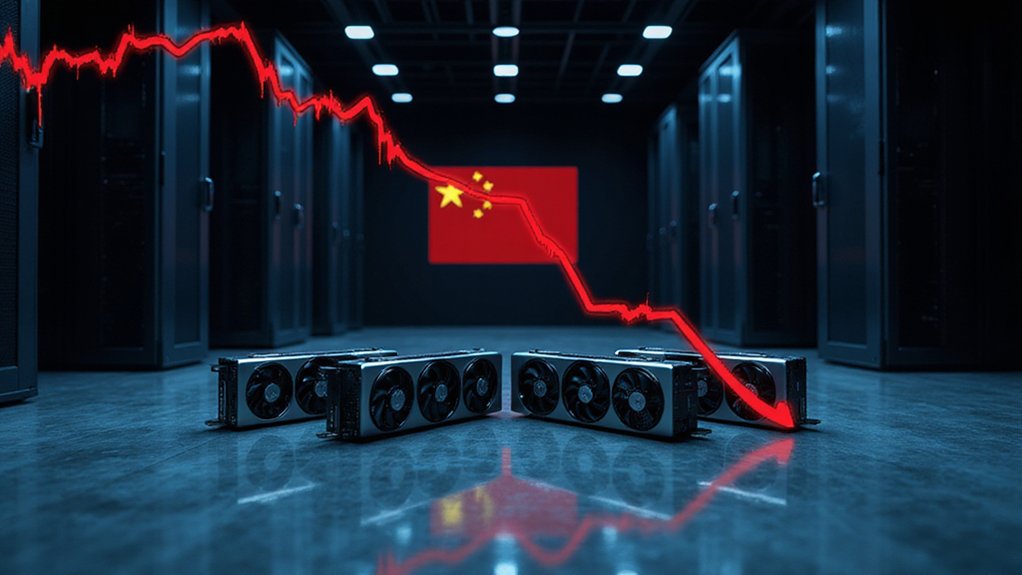

As global stock markets crashed in April 2025, tech giants faced their most challenging period in years. The collapse began on April 2, when markets plummeted in response to aggressive new tariffs imposed by the US government. Technology stocks were among the hardest hit, with major companies losing billions in market value overnight.

The tariffs targeted critical technology imports and exports, worsening trade tensions with China, Canada, and Mexico. These protectionist policies disrupted the global supply chains that tech manufacturers rely on. Companies saw their costs rise and profit margins shrink as components became more expensive.

Panic selling swept through markets as the NASDAQ experienced dramatic drops. Investors, worried about shrinking growth forecasts, pulled money from tech stocks at record rates. The sell-off marked the largest market decline since the 2020 pandemic crash.

The market turmoil exposed an investment bubble in AI and technology that had been building for years. Before the crash, tech valuations had soared based on optimistic AI growth projections. When these expectations weren’t met, capital began flowing out of AI-centered companies. The once-booming global AI market that reached $136.55 billion in 2022 saw its projected growth trajectory shatter. Venture funding for AI projects dropped sharply.

Initially, investors moved their assets to bonds, briefly lowering borrowing costs for tech firms. However, the bond market soon reversed course with mass sell-offs, further eroding confidence in all sectors. This “bond vigilantism” signaled growing mistrust in government fiscal policy. The Nasdaq Composite lost an astounding 1,600 points on April 3 alone, highlighting the severity of the tech sector collapse.

By June 2025, markets showed signs of partial recovery. The NASDAQ and S&P 500 reached new highs, but many tech giants remained below their previous valuations. The crash forced tech companies to announce significant cost-cutting measures, including layoffs and project cancellations.

The crisis revealed how vulnerable tech giants had become to market volatility and trade disruptions. It also highlighted the risks of overreliance on AI investments without proven short-term profitability. As markets stabilized, investors began reassessing the realistic scale and timeline for AI applications.